Compressed Air Energy Storage May Get a New Breath of Life

October 30, 2014It’s been a long dry spell for compressed-air energy storage (CAES). More than 20 years have passed since the last ribbon-cutting ceremony at a new CAES plant. But a combination of new technology, government mandate and technology innovation could breathe life into the becalmed CAES market.

Conventional CAES is a decades-old technology that allows low-cost off-peak power to be used to meet peak demand. CAES systems use a compressor to pressurize air and pump it into underground geological formations like caverns. This is done at night, when energy demand is low. During the day, air is released from the storage reservoir, heated with natural gas and forced through a turbine to produce electric power.

CAES technology is relatively inexpensive and can store large amounts of electricity. The storage volumes it can handle distinguish it from batteries, which “provide energy but not capacity,” says Septimus van der Linden, a consultant to the electric power industry. “If you suddenly need energy, a battery will respond. But 15 minutes later, the energy is gone.” By contrast, he says, the McIntosh CAES plant in Alabama can deliver about 100 MW of energy for as much as 26 hours.

On the downside, creating a CAES facility is a complex undertaking. Tasks involved include site selection, acquiring government permits and coordinating with entities that will produce and use the stored power, says Aaron Marks, a senior research analyst at IHS Energy. (Download a copy of the IHS Energy report "The Value of US Power Supply Diversity.")

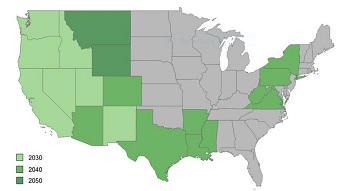

Perhaps the biggest disadvantage of conventional CAES is the need for a large geological formation that can accommodate both the storage and the rapid withdrawal of high-pressure air. Finding such formations has been “the real challenge” in siting a number of recently proposed CAES plants, says Paul Denholm, a senior energy analyst at the National Renewable Energy Laboratory (NREL) in Golden, Colo.

At present, there are two functioning utility-scale CAES plants in the world: the McIntosh plant in Alabama, which began operating in 1991, and a 290 MW facility in Huntorf, Germany, that dates back to 1978.

Challenges to CAES Deployment

Over the last decade, however, a large number of CAES projects have been proposed. Denholm attributes at least part of the failure of any of these to cross the finish line to the geological challenges presented. But there are other factors that have held back all forms of energy storage: a growing abundance of low-cost natural gas and a big drop in the price tag of gas turbine technology. Denholm says these factors have made it more appealing for utilities to bring additional energy generation capacity online than to consider unfamiliar energy storage technology.

Linking renewable energy resources to a storage facility like a CAES enables them to operate more like a conventional power plant. Source: NREL, credit Warren Gretz

Linking renewable energy resources to a storage facility like a CAES enables them to operate more like a conventional power plant. Source: NREL, credit Warren GretzCAES also has received a boost from government support for storage. For example, California has issued one of the first energy-storage mandates in the United States. It requires the state's three major investor-owned power companies to have electricity storage capacity that can output 1,325 MW by the end of 2020. California also offers subsidies for energy storage.

At the federal level, IHS analyst Marks says out that several CAES projects have been funded by the U.S. Department of Energy, while three more were awarded American Recovery and Reinvestment Act grants.

Technology Advancements

Another plus for CAES is that companies continue to develop the technology despite its lack of success in the marketplace. One such firm is Houston-based Dresser-Rand, which supplied the CAES system for the Alabama plant. Over the years, the company’s CAES technology has benefited from improvements in compressors and other Dresser-Rand equipment developed for the oil and gas industry.

Dresser-Rand’s current CAES offering, called SMARTCAES, includes all the necessary rotating and heat-exchange equipment, as well as plant controls. Thanks to an additional high-pressure expander turbine, the same CAES footprint that produces 110 MW at the Alabama plant can now produce 135-160 MW, says Jim Heid, a Dresser-Rand senior vice president who oversees the company’s CAES technology.

To date, no SMARTCAES equipment has been installed. But Dresser-Rand is currently involved in a number of proposed CAES projects. Three are in Texas and one of these, the 317 MW Bethel Energy Center in Anderson County, is under construction. SMARTCAES equipment has been ordered for the Bethel project but has yet to be delivered.

Dresser-Rand is also one of four companies that recently unveiled an $8-billion initiative that could bring large amounts of emission-free electricity to the Los Angeles area within a decade. The firms are expected to formally submit their proposal to the Southern California Public Power Authority by early next year.

According to Heid, the power will come from a 2,100 MW wind plant to be constructed in Wyoming. A 525-mile transmission line would carry the wind-generated electricity to a 1,280 MW CAES facility in Utah, which would include eight SMARTCAES “trains,” or lines.

CAES Innovation

When air is compressed in a CAES process, it heats up. But when it is released at the other end of the process, the expanding air cools. This prevents it from expanding as much as it would have if it had stayed at its original temperature and reduces the expanding air’s potential power output. As a result, conventional CAES relies on an external fuel source to provide heating in the expansion phase. And for this reason, it is not true energy storage, says Travis O’Guin, business development manager for a Berkeley, Calif., energy storage startup called LightSail Energy. Instead, O’Guin says, conventional CAES is “a hybrid storage/generation technology because it requires the burning of natural gas to add energy back into the system.”

LightSail’s alternative is to remove heat from the compression chamber as it is being created and then add it back during expansion. The company’s adiabatic CAES system does this by injecting water spray into the compression chamber to absorb heat energy. The warm water and pressurized air are then separated and stored. During expansion, the heated water is sprayed back into the air to boost power output.ightSail’s technology is still in the development phase. One thing the company is working on is improving the system's efficiency. O’Guin says the first units the company ships will offer roughly 55% roundtrip efficiency. LightSail’s goal is to eventually increase that to 70%.\

“Our system will probably not have the efficiency of battery technologies, but it will have double the lifetime” and last at least 20 years, he says.

LightSail could have pilot units operating by the end of 2015. The first commercial units should be ready for customers in 2016, O’Guin says.

While conventional CAES projects are large installations, LightSail will target projects in the 0.5 MW to double-digit megawatt size range. The company initially will aim its technology at so-called “microgrids” in remote and island communities. These communities normally import expensive diesel fuel to run generators that power their grids. Paired with a solar farm, however, storage theoretically can allow communities to use solar energy to power their grids around the clock.

Another difference between LightSail’s technology and conventional CAES is that is doesn’t require large underground storage reservoirs. Instead, the compressed air will be stored above ground in high-pressure tanks. That means the system can be sited almost anywhere, not just in areas where there is a suitable geological formation. The idea of using above-ground air storage in tanks or pipes opens up new business opportunities for CAES, says Marks.

On the other hand, CAES systems that rely on storage tanks can only provide short-duration power, says NREL’s Denholm: “If you want to store large volumes of energy, you will still need a large underground formation.”

Additional Resources: